Many leading consumer product and service providers allocate a financial value to their customers. Their motivation for doing so is almost always commercial. The increasing number of organisations serving the needs of the World’s very poorest customers are also keen to place a ‘value’ on their customers. Their motivations for doing so are often more complex and the techniques they use need to reflect this.

A dedication to Doug Leather

Firstly, a self-indulgent dedication of this item to the late and irreplaceable Doug Leather. It was Doug’s work with CGAP advising providers of micro-finance to very poor customers that drove the discussions on which the item is based.

Thinking wider than purely commercial motivation

So, to customer value and specifically of the financially poor consumers for which a growing range of ‘micro’ versions of mainstream products are being developed. These micro products range from very low denomination mobile phone top-ups through engineered-down physical products such as radios and computers to specially designed micro-finance services such as insurance and banking. The organisations investing in providing these offerings vary from those that specialise only in this area to the ‘social conscience’ business units of huge multi-nationals. The common thread between them is that their driving motivation includes factors other than pure financial return, although it is clearly recognised that they are not charitable organisations and are absolutely seeking a return on their investment. It is this multi-dimensional motivation that makes customer valuation more difficult that for the more one-dimensional motivation of most (not all) mainstream, commercial organisations.

Setting a scope – the value of customers to product and service providers

In order to keep this item focussed I have put some scope boundaries on it. The main one is that I am discussing the way in which organisations place a value on the customers who they already service or those they wish to service. I completely recognise the importance of looking at value from the customers’ view-point but that is a different, although closely-related topic.

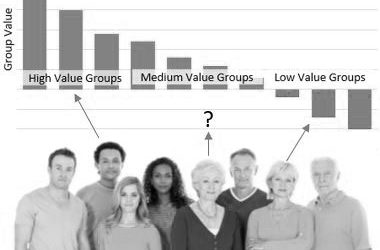

Let us also put aside the issues around the fact that placing an explicit financial value on individual customers can be seen as de-personalising people into units of value or simply as invasive. This is especially true when the valuation is formalised into a value segmentation that drives different value propositions to different value groups. On a number of occasions I have found myself having the “It’s not fair” argument with highly-educated, senior people in large Western corporations. It is surely even more potentially sensitive in situations where the customers are themselves extremely poor.

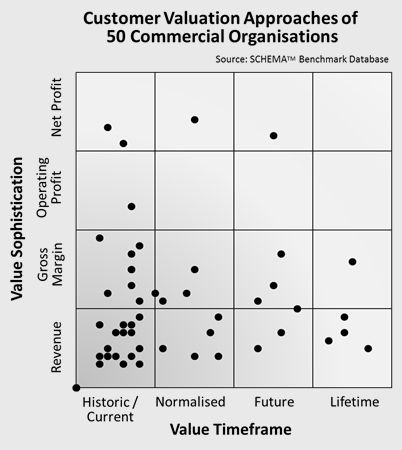

A simple framework for core financial value dimension

Placing a specific, financial value on individual customers is difficult in any organisation, even those with deep and broad information on their customers. Common definitions are rare so organisations have to create their own, a process which I have seen take over 12 months before any measurement or analysis even starts. For instance, what does “Lifetime Value” mean? Is it literally from birth to death including periods of customer loss and subsequent winback? Is it the value of a particular tenure (i.e. until next loss of that customer)? Or does it have to be constrained to a defined timescale (e.g. Past value plus 10 years into the future)?

Then there is the revenue to profit continuum. Does financial value have to be measured at the customer revenue level or can it be measured at some form of profit level, possibly using techniques such as activity-based-costing to allocate direct costs. Some organisations even allocate all overheads using agreed (but normally quite arbitrary) algorithms. These decisions will apply just as much to organisations servicing poor customers as to those servicing higher value or even business customers.

The matrix shown here represents the previous two paragraphs of discussion. I have also added the positions of over 50 organisations from a range of markets that have been assessed using the widely accepted SCHEMA™ methodology. These show the relative immaturity of all but a few mainstream commercial organisations in terms of customer valuation.

What does ‘Value’ mean in the context of poor customers?

So far I have allowed myself to use the term ‘Value’ without exploring what this actually means. I will use the rest of the item to share some thoughts on what this needs to mean and especially in the valuing of very poor customers. Even in mainstream markets the term ‘value’ is now being extended to encompass elements of indirect but still quite pragmatic benefit to the organisation. Advocacy is a typical and increasingly common example, especially where is can be measured by recommendations and referrals. Engagement is also becoming valued where it can be measured in terms of content contributions to websites or social media areas. This is also increasingly relevant for very poor customers but I believe that we have to think more widely for these customers.

Let us make the assumption that the motivation behind creating products, services, organisations or business units to serve the needs of very poor people is rarely because it is perceived as providing the best available returns on investment from all the options available. The other motivations may be genuinely altruistic or may be driven by a perceived need to be responsible global, corporate citizens. In either case I would suggest that a simple framework or set of scales against which to begin to build value definitions would be useful. The framework can never deliver detailed definitions that will satisfy the needs of all organisations but it can provide a thought prompter and basic shape to a value definition that will reflect the wider corporate motivations and different consumer dynamics than in the mainstream commercial world.

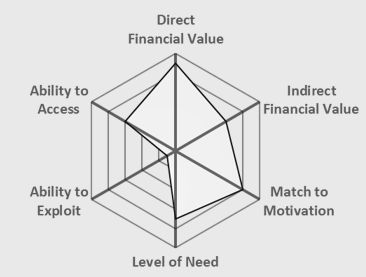

Direct Financial Value

This dimension is almost identical to the main motivation for most commercial organisations to build a specific business or to diversify into a new area of business. It is measured in terms of dollars at some level of sophistication on the matrix shown previously. I say ‘almost’ identical because much more care is needed in terminology and in measurement for very poor customers who will normally have a relatively low direct financial value. Using terms such as ‘High’ value or ‘Low’ value to differentiate customers on this dimension may not be appropriate and may even be mis-leading. Attempts to get to the deeper profitability levels may also drive poor decisions by trying to amortise direct costs or overheads across relatively little revenue.

However, we must never forget that many businesses servicing poor customers still have a primarily commercial motivation for doing so and have access to the same good information to understand this dimension of value as any other organisation.

Indirect Financial Value

Again, this dimension should be applied in a similar way as for other organisations and the way they attribute a value to it. Some do so by allocating an actual financial value based on the number of customers that referrers or advocates do or could generate. Most do so in a less financial way but still recognise people who are known opinion formers or ‘go-to’ individuals in assessing their value. This is potentially very important when dealing with poor communities, particularly where they are relatively isolated with a clear social structure and explicitly recognised advisors such as village elders or more highly educated community members.

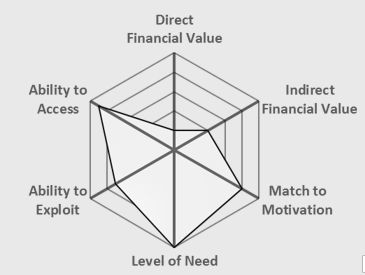

Match to Motivation

This dimension does exist to some degree in mainstream customer valuation where organisations will have often have objectives and targets around particular types of customers. So, for instance, a customer from a specific socio-economic group may be valued more highly where they match the organisation’s customer-mix motivations. In the context of the markets being discussed here the non-financial motivations may be informal and ‘nice-to-achieve’ or they may be core to the mission of the organisation or business unit. For instance, protection of children, re-positioning of Women, enabling self-help. In these cases individual customers or customer groupings that represent the core motivation can be considered higher value (all other things being equal) to the organisation than those without such a good match to their motivations.

Level of Need

Level of Need is a well-accepted alternative to financial value as the core dimension of success by many public sector organisations and by charities. The degree to which ‘Value’ can be directly replaced by ‘Need’ in talking about managing customers / beneficiaries has always surprised me, even after having been working with the concept for many years. The main difference is that there is no commonly accepted unit of ‘need’ and the upper and lower extremes of the scale vary dramatically. In some cases the need, if un-met, will result in death. In other situations the need, if met, can result in a better future for a whole family or even community. So, organisations need to develop their own scales for the needs that they are aiming to address. This requires careful attention but is not actually too difficult especially if basic concepts are borrowed from the risk management community who are used to quantifying the occurrence or non-occurrence of events.

Ability to Exploit

Although the ability of the target market to exploit products and services designed, or modified, for them should have been considered at the design / development phase, not all customers will have the same ability. Some customers will be able to derive greater value from the same product or service than others. This may be due to differing levels of education, which is particularly important where products are relatively sophisticated. It may be due to access to pre-requisites such as electricity or internet access. Creativity and lateral-thinking is needed in forming a scale for this dimension but it can be done in most cases, possibly by some form of proxy. For instance: Size of local population divided by Internet Access points in the community; penetration of mobile phones in the community etc.

Ability to Access

This is where considerations become more sensitive and potentially even distasteful to some. The concept of this dimension is that (again, all other things being equal) some potentially high value customers by the other dimensions may simply be unable to access the products or services being provided. The reasons can be logistical, seasonal, economic or a number of other long-standing barrier types. Unfortunately, in the modern world, the reasons are too often political, factional or caused by corruption or ‘diversion’ of products and services away from the customers at whom they are targeted. It is a difficult scale for an organisation to recognise but the reality is that if people are prevented in moving freely to service delivery points or are likely to be targeted for theft after accessing a service then their value as a customer must (questionably) be considered lower.

What does it all mean?

Given the relatively short, introductory nature of this item I would not expect any ‘eureka’ moments from readers. I hope that I have accurately represented the conversations that I had with Doug Leather and possibly moved them forward a little, providing at least a framework for more thinking.

Really? It really is excellent to witness anyone ultimate begin addressing this stuff, however I?m still not really certain how much I agree with you on it all. I subscribed to your rss feed though and will certainly keep following your writing and possibly down the road I may chime in once again in much more detail good work. Cheers for blogging though!